BTC declines then recovers after Fed stays on hold. – CoinDesk

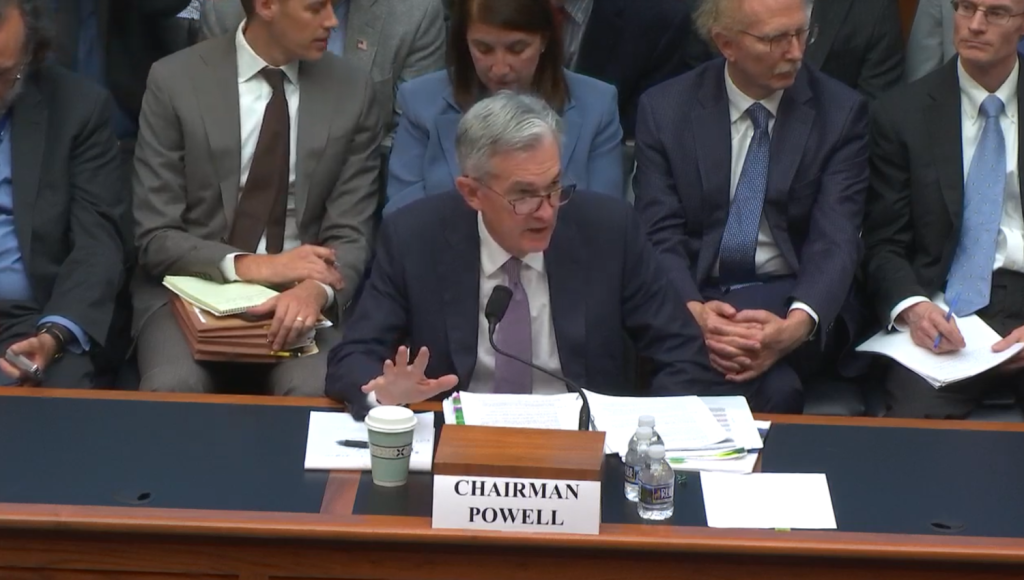

As expected, the U.S. Federal Reserve has kept its benchmark fed funds range rate steady at 4.25%-4.50%, the first pause since the central bank began easing policy last September.The accompanying policy statement noted that the unemployment rate had stabilized at a “low level” and inflation remained “somewhat elevated.” The wording was hawkish as it removed last month’s reference to “progress” on inflation moving to its 2% target. Under pressure for most of this week, the price of bitcoin (BTC) dipped to $101,800 shortly following the news. U.S. stocks added to the day’s losses, with the Nasdaq down 1.1% and the S&P 500 lower by 0.9%. The dollar and gold were little-changed and the 10-year Treasury yield rose 5 basis points to 4.59%.Since the Fed’s first September rate cut, the fed funds rate has been slashed by 100 basis points. The U.S. 10-year Treasury yield, however, has gone in the opposite direction, rising to 4.6% fro 3.6% — a divergence between short-term and long-term rates that rarely has been seen.That divergence as well as a series of stronger than expected reports on the economy and inflation has not been lost on the Fed. Following the bank’s December meeting, Chair Jerome Powell made clear that any further rate cuts — at least for the moment — were on hold.At his post-meeting press conference, Powell said the change in the policy statement language with respect to inflation was not done to send any sort of message. Both bitcoin and stocks moved off earlier lows following his remarks, with bitcoin rising above $103,000 at the time of the press conference’s end.Update (Jan. 29, 20:13 UTC): Added news from the Powell press conference and updated price action.James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin, MicroStrategy (MSTR), and Semler Scientific (SMLR).AboutContactPolicies

Source: https://www.coindesk.com/markets/2025/01/28/fed-holds-rates-steady-takes-note-of-elevated-inflation